Before the present crisis the World Bank has classified Syria’s economy as having a lower middle income level within the region Middle East & North Africa. Syria’s economy is essentially state-run, although it has remained partly private, as for example the retail trade businesses. Bashar al-Assad, who became President in 2000, started to privatize more sectors of the economy. Until recently, Syria had trouble attracting foreign investors, as 51 percent of a business’ capital had to be Syrian. In 2009, more reforms were announced, opening up the financial sector as well.

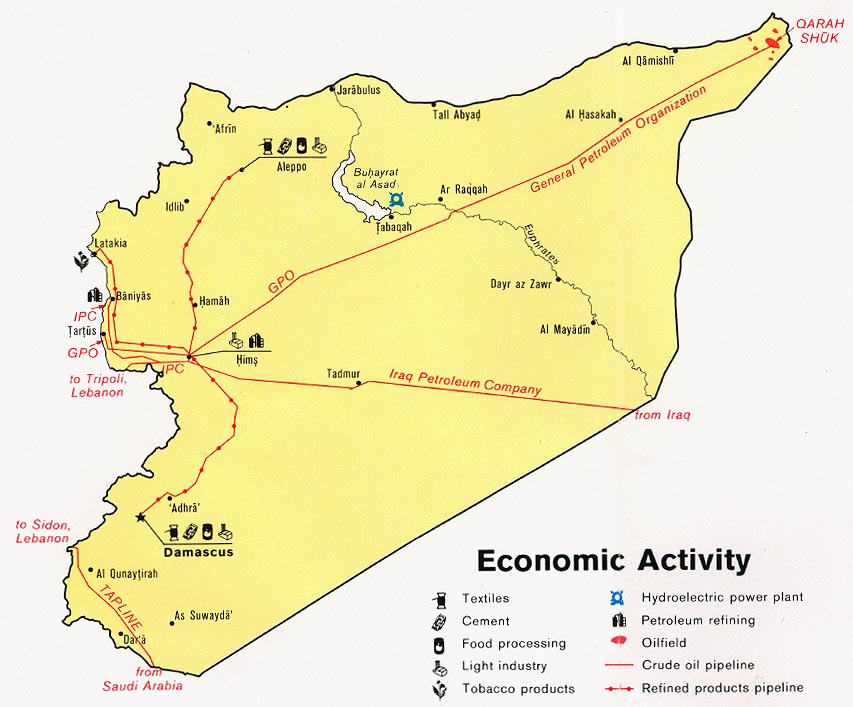

Economic activity in Syria (Nation Masters – Maps Syria)

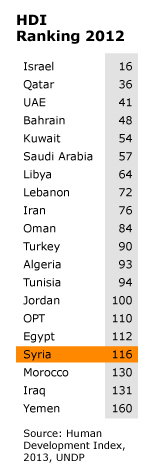

In many respects, Syria is still a poor country that relies heavily on help, mainly from rich Arab states but also from the European Union or from UN organizations such as the United Nations Development Programme (UNDP). Its Human Development Index (HDI), though rising over the years, is lower (0.648) in view of Syria’s GDP. In this respect, Syria ranks 116 out of 186. When compared to other countries in the region,

it ranks below Egypt, leaving only Morocco, Iraq, and Yemen at the bottom.

For decades, Syria’s international economic policy was subordinate to its foreign policy. Until the outbreak of the Syrian conflict, it was however slowly coming out of its isolation vis-à-vis the West. In 2003, Syria signed an agreement with the EU, one of the last Mediterranean countries to do so. In 2010, negotiations started to join the World Trade Organization.

For decades, Syria’s international economic policy was subordinate to its foreign policy. Until the outbreak of the Syrian conflict, it was however slowly coming out of its isolation vis-à-vis the West. In 2003, Syria signed an agreement with the EU, one of the last Mediterranean countries to do so. In 2010, negotiations started to join the World Trade Organization.

In many respects, Syria is still a poor country that relies heavily on help, mainly from rich Arab states but also from the European Union or from UN organizations such as the United Nations Development Programme (UNDP). Its Human Development Index (HDI), though rising over the years, is lower (0.648) in view of Syria’s GDP. In this respect, Syria ranks 116 out of 186. When compared to other countries in the region, it ranks below Egypt, leaving only Morocco, Iraq, and Yemen at the bottom.

Basic figures

Syria’s GDP was $73.67 billion in 2012 (World Bank) and rose enourmous over the last few years. The GDP growth (annual percentage) was 3.2 in 2010, and 5.0 in 2010 (projection). According to MEED, GDP growth was -6 in 2011 and -14 in 2012 (estimate). GDP per capita was 2,892 USD in 2010 (Atlas method) and USD 4,350. Agriculture contributes 23 percent to the GDP, industry 30 percent, services 46 percent (2009). Workers’ remittances and compensation of employees numbered USD 850 million. Foreign Aid in 2007, Official Development Assistance (ODA) and official aid was 113 million USD (against 1,698 million in 1980) in 2011; the three main donors were the European Commission (36.55 million), France (22.2 million), and Italy (3 million). Total aid is 0.1 percent of GDP. Grants, excluding technical cooperation, amounted to USD 332 million (World Bank 2011). Today, according to MEED (summer 2012) Syria is on track to suffer the longest recession in the region due to continued violence, rising inflation, prolonged drought and dwindling monetary reserves.

Syria has released new cash into circulation (July 2012) to finance its fiscal deficit, flirting with inflation after violence and sanctions wiped out revenues and led to a severe economic contraction, bankers in Damascus say (FreeSpeech.org –Syrian Prints New Currency).

Syria has released new cash into circulation (July 2012) to finance its fiscal deficit, flirting with inflation after violence and sanctions wiped out revenues and led to a severe economic contraction, bankers in Damascus say (FreeSpeech.org –Syrian Prints New Currency).

Crisis

It is no surprise that the present conflict has a significant economic impact on Syria. In the autumn of 2011 the Syrian economy appeared already to be effected by the increasing protests. According to unconfirmed estimates, the economy may have contracted about 4 percent in 2011, about 30 percent in 2012, and further by about 7 percent in the first quarter of 2013. Most affected by the conflict, as well as by the subsequent international sanctions, were transportation, communications, mining and manufacturing, retail trade, and tourism. And its chances of recovery are looking slim. “Syria is now fully a war economy that displays all the features of a country in conflict,” Samer Abboud, assistant professor of history and international studies at Arcadia University, told Trend Lines in an email interview published in YaLiban. “There is increased informality and black market activity, an increase in criminality and markets for violence, families trying to cope under these conditions by whatever means possible and so on” (Ya Liban, Syria now fully a war economy, report).

Prior to the crisis, Syria’s economic reform efforts had helped to strengthen its growth performance although external and domestic shocks, particularly the impact of the global financial crisis and prolonged drought, had adversely affected Syria’s macroeconomic performance. In light of deteriorating security in Syria, World Bank operational activity and missions to the country have been halted since March 2011.

Once the conflict has subsided, Syria will grapple with immediate economic challenges including: output and employment collapse in the tradable sector; accelerated exchange rate depreciation in the parallel market; hoarding of hard foreign currency; likely foreign exchange reserve losses; rising inflation; and legal and financial issues associated with frozen assets.

It is next to impossible to present a clear picture of Syria’s economy due to the violent conflict. All statistics that are published are not valid anymore. The best might be to go for the latest news on Syria’s economy to the World Bank… and for a more general overview to GlobalEdge…

Resources

- Fanack.com Syria – Economy

- Index Mundi –Syria

- World Bank –Syria

- YaLiban – Syria Now Fully a War Economy, report